Welcome to the wild world of the Residential lease, where every tenant’s dream can either soar high or crash and burn quicker than a pizza in a too-hot oven! With a sprinkle of legal jargon and a dash of tenant-landlord tango, navigating this rental roadmap can be both a humorous ride and a serious commitment.

Fear not, brave lease-signers! This guide will unravel the mysteries of lease agreements, from the fine print that makes your head spin to the important rights and responsibilities that can turn a good living situation into a nightmare—or a superbly cozy castle!

Understanding Residential Leases

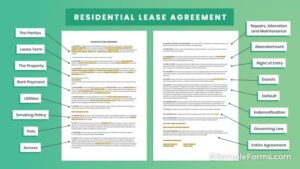

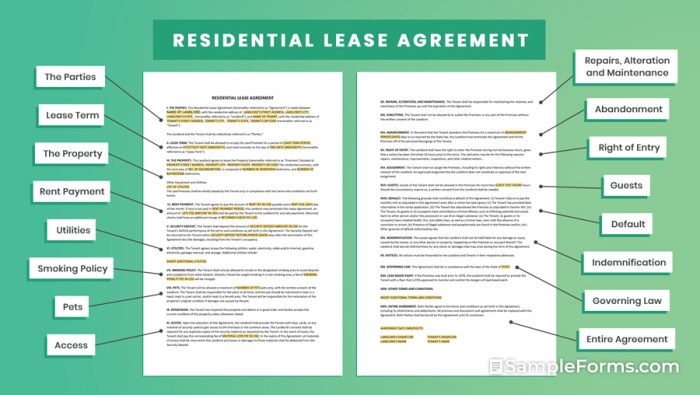

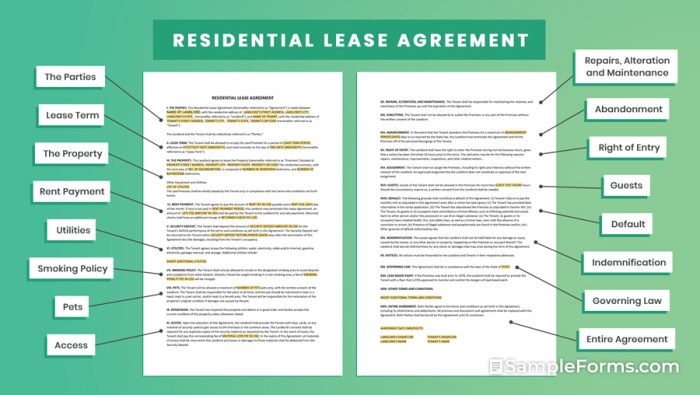

Residential leases are the backbone of tenant-landlord relationships, serving as the written contract that Artikels the terms of living in a rented property. It’s that sacred document that both parties cling to like a life raft on a sea of rental chaos. Misunderstanding a lease could lead to more drama than a soap opera, so let’s break it down in a way that even your pet goldfish could understand (with a little help from your end).The key components of a residential lease agreement generally include the lease term, rental amount, security deposit, and maintenance responsibilities.

Each of these elements plays a crucial role in defining the relationship between the tenant and landlord. Understanding these components ensures that everyone is on the same page, rather than improvising like a jazz musician at a rock concert.

Key Components of a Residential Lease Agreement

Every residential lease agreement comes with a blueprint of its own, detailing the responsibilities and rights of both parties. Here’s a quick overview of the essential components that should not be overlooked during your lease signing ceremony:

- Lease Term: This specifies the duration of the rental agreement, usually ranging from one year to month-to-month, depending on how adventurous you feel about your living situation.

- Rent Amount: This is the total rent due each month. Missing this figure could lead to a surprise eviction notice that will leave you singing the blues.

- Security Deposit: A safety net that landlords typically require to cover potential damages. Think of it as the landlord’s insurance policy against your questionable late-night dance parties.

- Maintenance Responsibilities: This Artikels who is responsible for repairs. A clear division minimizes the chances of a landlord showing up unannounced to fix the leaky faucet while you’re in your pajamas.

Common Terms and Conditions in Residential Leases

Residential leases are laced with terms and conditions designed to protect both parties. Missing even one could leave you feeling a bit like a contestant on a game show—excited yet confused. Familiarity with these terms can save you from potential heartaches in the future:

- Pet Policy: Some leases welcome furry friends, while others treat them like unwelcome tourists. Always read the fine print unless you want your future pet to be a cause for eviction.

- Notice Period: This stipulates how much notice you must give before vacating the property. Ignoring this could result in a landlord’s wrath that rivals that of a mother bear protecting her cubs.

- Late Fees: These are the penalties you’ll incur if you fail to pay rent on time. Think of them as a financial slap on the wrist for those who might be a little too laid-back about deadlines.

- Subletting Rules: This section informs you if you can rent your space to someone else. Ignoring it can lead to awkward confrontations and potential legal battles over who’s crashing at your place.

Rights and Responsibilities of Tenants and Landlords

Understanding the rights and responsibilities of both tenants and landlords helps to create a harmonious living environment, akin to a well-rehearsed dance routine. Each party plays a vital role in ensuring everything goes smoothly.

- Tenant Rights: These include the right to a habitable living space, privacy, and freedom from discrimination. Tenants are like the stars of the show, and their comfort should always be a top priority.

- Landlord Responsibilities: Landlords must ensure the property meets health and safety standards, maintain common areas, and provide necessary repairs. Imagine them as the directors of a blockbuster movie, responsible for ensuring everything runs without a hitch.

- Tenant Responsibilities: Tenants are expected to pay rent on time, keep the property clean, and report maintenance issues promptly. They are akin to the diligent cast members who must show up on time for every rehearsal.

- Landlord Rights: Landlords have the right to enter the property for repairs or inspections, but usually must provide notice first. They’re like the watchful producers, making sure everything is in order without interrupting the performance.

“Understanding your lease is like knowing the rules of a game—break them at your own risk!”

Each of these components, terms, and responsibilities forms an essential part of the intricate dance that is residential leasing. With a little humor and a lot of clarity, navigating these waters becomes much easier!

Financial Implications of Residential Leasing

Renting a home might sound as carefree as a picnic in the park, but lurking under the surface are financial elements that can either make your wallet sing or sob. When you sign a residential lease, you’re not just committing to a roof over your head; you’re diving into a delightful world of financial intricacies that deserve a good old-fashioned exploration.

So, grab your magnifying glass as we uncover the financial implications that come with leasing a residence.Understanding the financial elements of a residential lease is vital for any prospective renter. These elements include not just the monthly rent payment but also security deposits, utility costs, and potential fees for late payments or damages. Each of these components contributes to your overall financial picture and can significantly impact your budget and financial health.

A lease is more than just an agreement; it’s a financial commitment that can ripple through your credit score and financial stability.

Key Financial Elements of a Residential Lease

Navigating through the financial landscape of a residential lease can feel like walking through a minefield of costs. Here are the crucial elements you need to consider when examining a lease:

- Monthly Rent: The amount you pay every month to live in your cozy abode. This is the big ticket item and often the first thing we think of when signing a lease.

- Security Deposit: Typically one month’s rent, this safety net protects the landlord against potential damages. Just remember, it’s not a tip for your landlord’s great hospitality.

- Utilities: Often not included in rent, these are the bills that keep your lights on and your fridge humming. Make sure to clarify who pays what!

- Late Fees: A friendly reminder that paying rent late can cost you more than just a frown from your landlord. Keep those payments punctual!

- Lease Termination Fees: Think of this as a breakup fee. If you decide to leave early, be prepared to pay for the privilege of your hasty exit.

Negotiating Lease Terms for Better Financial Outcomes

When it comes to negotiating lease terms, think of yourself as a smooth-talking wizard wielding the magic of financial savvy. Here are some tips to ensure you emerge victorious from the negotiation table:

- Know Your Market: Before you sit down to negotiate, do your homework. Understanding average rents in your area gives you leverage when discussing terms.

- Offer Longer Lease Terms: If you’re planning to stay a while, proposing a longer lease may convince landlords to offer lower monthly rent in exchange for stability.

- Request Repairs and Upgrades: If something needs fixing, bring it to the table. Requesting repairs as part of the lease can save you money in the long run.

- Ask for a Rent Freeze: If you love the place, negotiate for a fixed rent amount for a year to avoid unexpected increases.

- Be Friendly, Not Pushy: Remember, you catch more flies with honey. A little charm can go a long way in negotiations!

Impact of Lease Agreements on Credit Scores and Financial Stability

Your residential lease doesn’t just decide where you’ll be living; it can also have a significant impact on your credit score and overall financial stability. Here’s how:

- Payment History: Lease payments are often reported to credit bureaus. On-time payments can boost your score, while late payments can do the opposite. Treat rent like a sacred bill!

- Debt-to-Income Ratio: Your lease adds to your financial responsibilities. A high rent in relation to your income can affect your borrowing power for future loans.

- Eviction Records: An eviction can hit your credit report like a freight train. Ensure you maintain good relations with your landlord to avoid this scenario.

- Rental History: A solid rental history can improve your chances of securing future leases or loans, as it demonstrates reliability and financial responsibility.

Related Financial Concepts

Entering into a residential lease is akin to adopting a pet; you need to ensure you can take care of it before bringing it home. Just as your furry friend requires food, love, and vet visits, your lease requires financial responsibility and planning. This is where credit counseling and effective debt management come into play, helping you navigate the world of rental obligations without drowning in a sea of bills.Credit counseling is like having a wise owl perched on your shoulder, offering guidance on how to manage your finances effectively when entering a lease.

It helps prospective tenants understand their credit scores and how these scores can impact their leasing options. A good credit score can open the door to better rental opportunities, lower security deposits, and even negotiated lease terms. Without it, you’re more likely to face a mountain of hassles, so it’s essential to seek counseling before diving into the leasing pool.

Importance of Credit Counseling

Credit counseling serves as your financial GPS, guiding you through the potentially treacherous terrain of credit scores and housing options. Here’s why it should be at the top of your to-do list before signing that lease:

- Understanding Credit Scores: Discover how credit scores are calculated and their importance in rental applications.

- Improving Financial Literacy: Learn about budgeting and financial management skills that can help you maintain your lease.

- Identifying Financial Goals: Set short-term and long-term financial goals that align with your rental commitments.

- Access to Resources: Gain insights into available resources and support systems to assist with financial planning.

Effective Debt Management in Rental Context

Managing debt is crucial for meeting rent obligations without feeling like a contestant on a reality show titled “Dancing with Creditors.” Effective debt management strategies can help tenants maintain a healthy financial balance while meeting their rental responsibilities. Here are some valuable methods:

- Budgeting: Create a comprehensive budget that includes rent, utilities, and other living expenses to avoid overspending.

- Prioritization: Prioritize rent payments over discretionary expenses to prevent falling behind.

- Emergency Fund: Establish an emergency fund to cover at least three months’ rent in case of unexpected financial setbacks.

- Debt Snowball Method: Focus on paying off smaller debts first to build momentum and improve overall financial standing.

Using Home Equity Loans to Finance Rental Properties

Home equity loans can be a nifty financial tool, similar to finding a secret stash of cookies when you thought the jar was empty. They allow homeowners to tap into the equity they’ve built to finance rental properties, but it’s essential to navigate this terrain wisely. Understanding how to use these loans effectively can enhance your rental portfolio without putting your home at risk.A home equity loan involves borrowing against the value of your home, providing you with a lump sum that can be used for investment.

Here’s a guide on how to navigate this option:

- Assess Equity: Determine how much equity you have in your home by evaluating its current market value versus what you owe.

- Loan Types: Understand different types of home equity loans available, such as fixed-rate loans and lines of credit.

- Investment Strategy: Develop a clear investment strategy for how the funds will be used, whether to purchase rental properties or fund renovations for existing rentals.

- Risk Management: Consider the risks involved, including fluctuating property values and potential repayment challenges.

Conclusion

In the grand finale of our Residential lease adventure, remember that knowing your lease is like knowing the secret handshake to the cool kids’ club of renting. Equip yourself with the knowledge of terms, financial implications, and related concepts, and you’ll be well on your way to becoming a lease-legend, leaving the chaos behind and enjoying every moment in your new abode!

FAQ Section

What is a residential lease?

A residential lease is a legal document that Artikels the terms under which a landlord allows a tenant to occupy a property.

How long do residential leases typically last?

Most residential leases last for one year, but they can be shorter or longer depending on the agreement.

Can landlords raise rent during a lease?

Generally, landlords cannot raise the rent until the lease expires unless the lease specifically allows for it.

What happens if I break my lease?

Breaking a lease can lead to penalties, including losing your security deposit or being required to pay rent until a new tenant is found.

Do I need renter’s insurance?

While it’s often not required, renter’s insurance is highly recommended to protect your belongings in case of theft or damage.