Welcome to the whimsical world of Wealth management trust, where your assets frolic in safety like puppies in a sunflower field! It’s not just about having a fancy bank account; it’s about ensuring that your hard-earned treasure is protected from the dastardly forces of financial chaos. Think of it as your financial fortress, complete with drawbridges and moats to keep out those pesky creditors and uninvited tax guests.

In this delightful journey, we’ll explore how wealth management trusts play a crucial role in financial planning, offering benefits that can make your portfolio sing. We’ll also delve into the crafty relationships between these trusts and strategies for estate planning, ensuring your wealth doesn’t just disappear into the great unknown when you do!

Wealth Management Trust Overview

Wealth management trusts are not just fancy terms thrown around at cocktail parties; they are essential tools in the realm of financial planning. Think of a wealth management trust as a well-tailored suit for your assets—designed to fit perfectly while protecting you from the unpredictable weather of life. With the right trust, you can safeguard your wealth and ensure that it’s distributed according to your wishes, rather than letting it become a game of chance.Establishing a wealth management trust is like locking your valuables in a high-tech safe while tossing the key into the ocean.

The importance of this trust lies in its ability to provide asset protection, tax benefits, and a strategic approach to estate planning. It’s your fortress against creditors, lawsuits, and the whims of fate. For example, if you amass a small fortune (or a collection of rare Beanie Babies), a trust can keep those treasures secure from potential threats, ensuring they go to your heirs rather than to the court system.

Benefits of Establishing a Wealth Management Trust for Asset Protection

The advantages of setting up a wealth management trust for asset protection are numerous and impactful. This trust acts not only as a shield but also as a wise advisor for your financial future. Here are the primary benefits:

- Creditor Protection: A wealth management trust is often exempt from creditors. This means if you face financial difficulties, your trust assets remain untouched and safe.

- Tax Advantages: Trusts can be structured to minimize tax liabilities. By placing assets in a trust, you could potentially lower your estate taxes and enjoy tax-deferred growth on investments.

- Control Over Distribution: A trust allows you to dictate how and when your assets are distributed among your beneficiaries, ensuring they receive their inheritance responsibly.

- Professional Management: Trusts are often managed by professional trustees who have the expertise to invest and grow your assets effectively, providing a level of financial acumen you may not possess.

Incorporating a wealth management trust into your financial plan is not merely smart—it’s prudent. Consider the Fictitious Family Fortune: They established a trust to protect their assets from sudden market downturns. When a recession hit, their investments were secure within the trust, allowing the family to avoid liquidation and maintain their lifestyle.

Relationship Between Wealth Management Trusts and Estate Planning Strategies

Wealth management trusts are intricately intertwined with effective estate planning strategies. A trust serves as a cornerstone of a comprehensive estate plan, providing clarity and order to what can often be a chaotic affair. By establishing a wealth management trust, you can ensure your legacy is handled precisely as you envision. Here’s how they work hand-in-hand:

- Avoiding Probate: Assets held in a trust typically bypass the lengthy probate process, allowing for a more expedited transfer to beneficiaries.

- Tax Efficiency: Trusts can be structured to minimize estate taxes, ensuring that more of your wealth is passed on rather than lost to taxation.

- Protecting Minor Beneficiaries: Establishing a trust allows for the management of assets for minor children or beneficiaries who may not be financially responsible.

- Maintaining Family Privacy: Unlike wills, which become public record, trusts can remain confidential, keeping your financial affairs private.

The Fictitious Family Foundation, for instance, enjoyed a smooth transition of its wealth to the next generation by leveraging a wealth management trust. Their estate plan was seamlessly executed, and the family avoided the pitfalls of probate, ensuring that their beloved summer home remained in the family without any hassle. In summary, a wealth management trust is more than just a financial tool; it’s the Swiss Army knife of wealth protection and estate planning, ready to tackle whatever challenges come its way while keeping your assets safe and sound.

Financial Tools Related to Wealth Management Trust

In the grand circus of wealth management, financial tools serve as the jugglers, expertly tossing around your assets, debts, and dreams. They keep everything in balance and prevent any financial clowns from crashing the show. Let’s explore the key players in this financial arena: credit counseling, debt consolidation, and home equity loans.

Credit Counseling in Debt Management

Credit counseling is like having a financial coach in your corner, equipped with a whistle and a playbook to help you tackle debts associated with wealth management. This service provides professional advice tailored to your unique financial situation, guiding you through the maze of bills and balances. With the help of a credit counselor, you can:

- Understand your credit report, so those pesky numbers become your friends rather than foes.

- Create a personalized budget that ensures you’re not living off instant ramen while trying to pay off debts.

- Explore debt management plans (DMPs), which can simplify payments by combining multiple debts into one easy monthly installment.

Credit counseling can significantly reduce stress, allowing you to focus on wealth-building instead of just wealth-maintaining.

Debt Consolidation Methods

Debt consolidation is akin to a financial smoothie – blending various debts into a single, more manageable concoction. This method simplifies your payments while often lowering interest rates. Here are some effective methods to consider:

- Personal Loans: These unsecured loans can provide a lump sum to pay off multiple debts, leaving you with just one monthly payment to manage.

- Balance Transfer Credit Cards: Transfer high-interest credit card debts to a card with a lower interest rate, often with promotional offers that can save you a bundle.

- Home Equity Loans: Tap into your home’s equity for a lump sum to pay off existing debts, potentially at a lower interest rate than other types of loans.

Each of these methods has its pros and cons, so it’s important to review your financial situation before diving headfirst into the debt-consolidation pool.

Home Equity Loans as Financial Tools

Home equity loans are like the versatile Swiss Army knife of the wealth management toolkit. They allow you to borrow against the equity you’ve built in your home, providing a reliable source of funding for various financial needs, all while keeping your wealth management trust on track.These loans can be particularly advantageous because:

- They typically offer lower interest rates compared to unsecured loans, making them a cost-effective borrowing option.

- The interest may be tax-deductible, providing potential tax benefits that can further enhance your wealth.

- Home equity loans can be used for anything from debt consolidation to home improvements, giving you flexibility in how you manage your finances.

However, it’s crucial to approach home equity loans with caution, as they can put your home at risk if payments are missed. Like all good things in life, moderation and careful planning are key.

Strategies for Effective Wealth Management

Wealth management is like juggling flaming torches while riding a unicycle; it requires skill, balance, and a pinch of bravery. To optimize your financial portfolio, you need to have a strategy that incorporates not only growth but also protection against the unexpected. Here, we explore various strategies that can make your wealth flourish while keeping you from catching fire.

Debt Management Strategies to Optimize Wealth

Managing debt effectively is a cornerstone of any successful wealth management strategy. It’s important to treat debt like a mischievous pet; tame it, and it can be your ally. Below are some debt management strategies that can help optimize your wealth:

- Consolidation: Think of this as putting all your mischievous pets into one big, cozy pen. Consolidating multiple debts into a single loan can simplify payments and potentially lower interest rates, leading to less financial chaos.

- Snowball Method: Focus on paying off the smallest debts first while making minimum payments on larger ones. It’s like taking first steps in a marathon—small wins can give the motivation to tackle the bigger challenges.

- Refinancing: This is akin to upgrading your old, rickety bike to a shiny new model. By refinancing high-interest debts into loans with lower rates, you can significantly reduce your interest payments and pay off debt faster.

- Strategic Payments: Prioritize paying off debts with the highest interest rates. This is like tackling the toughest hills on your cycling route first—less resistance later on makes the ride smoother.

Tips for Currency Trading that Complement Wealth Management

Currency trading can be a thrilling rollercoaster, but without proper tips, you might find yourself upside down. Here are some tips that can enhance your wealth management efforts while trading currencies:

- Stay Informed: Keep an eye on global news and economic indicators. Knowledge is the fuel that powers your trading engine—without it, you might run out of gas!

- Use Stop-Loss Orders: Protect your investments like a knight guarding a castle. Stop-loss orders can help minimize losses by automatically selling assets when they hit a certain price.

- Diversify Currency Pairs: Don’t put all your eggs in one basket. Explore different currency pairs to spread risk and take advantage of various market movements.

- Practice with a Demo Account: Test your strategies without the fear of losing real money. It’s like practicing your dance moves at home before hitting the dance floor.

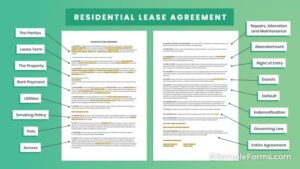

Leveraging Leases and Leasing in Wealth Management Planning

Leases can be a secret weapon in your wealth management toolbox. They allow you to enjoy the benefits of ownership without the hefty price tag. Here’s how to effectively leverage leases in your planning:

- Cash Flow Management: Leasing can free up cash flow by avoiding substantial upfront costs. This is like renting a mansion for a vacation instead of buying it—enjoy luxury without long-term commitment!

- Tax Benefits: Lease payments are often tax-deductible, which is like getting a discount on your financial obligations. This can reduce your overall tax burden and offer more money to invest elsewhere.

- Flexibility: Leasing allows you to upgrade to newer models or equipment easily. It’s like having a wardrobe that always includes the latest fashions without committing to the full price.

- Risk Mitigation: By leasing rather than buying, you avoid the risks associated with depreciation. This is akin to taking a taxi instead of driving—less responsibility, more freedom!

Last Recap

So there you have it, folks! Wealth management trusts are like your financial superheroes, swooping in to save the day when it comes to asset protection and strategic planning. With the right tools and strategies, you can optimize your wealth and ensure your legacy is passed on without a hitch. Remember, the key to financial happiness is not just in making money but in keeping it safe and sound for generations to come!

Helpful Answers

What exactly is a wealth management trust?

A wealth management trust is a legal entity that holds and manages assets on behalf of an individual, ensuring those assets are protected and optimally managed.

How does a wealth management trust benefit estate planning?

It helps streamline the transfer of assets upon death, minimizes estate taxes, and provides clear instructions for asset distribution, avoiding potential family feuds.

Can I access my assets in a wealth management trust?

Yes, you can access your assets, but they will be managed according to the trust’s terms, hence providing a layer of protection and strategic management.

What are the costs associated with setting up a wealth management trust?

Costs can vary, but typically include legal fees, setup fees, and ongoing management fees, so be sure to check your wallet!

Is a wealth management trust only for the super-rich?

Not at all! While it’s popular among high-net-worth individuals, anyone with assets to protect can benefit from a wealth management trust.